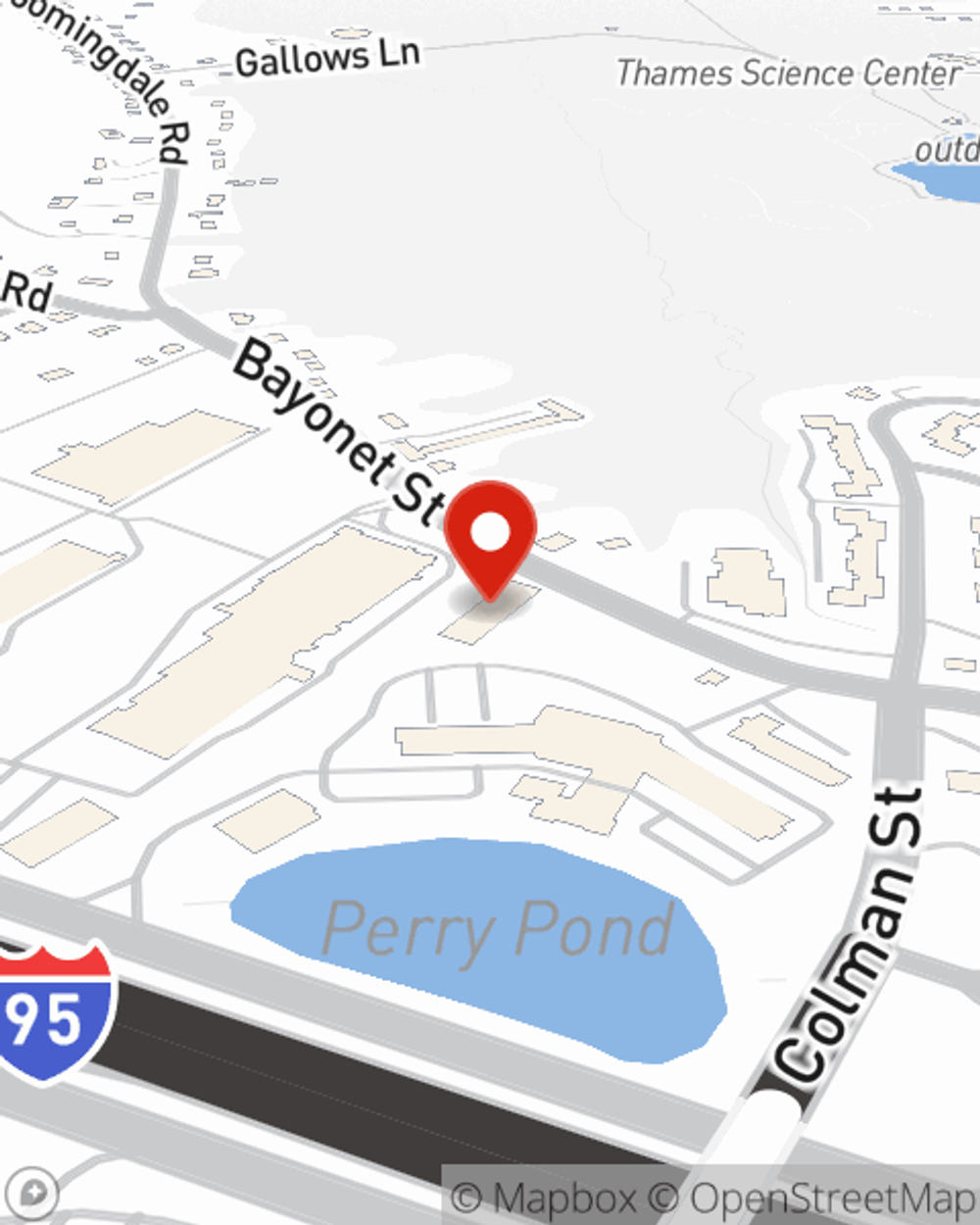

Life Insurance in and around New London

Coverage for your loved ones' sake

Life happens. Don't wait.

Would you like to create a personalized life quote?

It's Time To Think Life Insurance

Do you know what funerals cost these days? Most people aren't aware that the mean cost of a funeral in the U.S. is $8,500. That’s a heavy burden to carry when they are facing grief and pain. If those closest to you cannot pay for your burial or cremation, they may be unable to make ends meet in the wake of your passing. With a life insurance policy from State Farm, your family can survive, even without your income. Whether it maintains a current standard of living, pays off debts or pays for college, the life insurance you choose can be there when it’s needed most by your loved ones.

Coverage for your loved ones' sake

Life happens. Don't wait.

Put Those Worries To Rest

Some of your options with State Farm include coverage for a specific number of years or coverage for a specific time frame. But these options aren't the only reason to choose State Farm. Agent Christine Wagner's fantastic customer service is what makes Christine Wagner a great asset in helping you opt for the right policy.

Interested in exploring what State Farm can do for you? Get in touch with agent Christine Wagner today to get to know your unique Life insurance options.

Have More Questions About Life Insurance?

Call Christine at (860) 444-8011 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Why go paperless and engage digitally?

Why go paperless and engage digitally?

Customers are moving more towards receiving communications digitally. We'll explain what that could mean to you.

Christine Wagner

State Farm® Insurance AgentSimple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Why go paperless and engage digitally?

Why go paperless and engage digitally?

Customers are moving more towards receiving communications digitally. We'll explain what that could mean to you.